Don’t Know the requirements for student loan forgiveness?

In this article, you’ll learn how you can qualify for your student loan forgiveness, and much more. Continue reading the article!

Table of Contents

Student loan forgiveness is of great importance because it reduces the heavy burden of student loans.

This policy promotes economic relief, and social equality, and encourages economic growth by empowering individuals to invest in various aspects of their lives. Student loan borrowers can now register online for the new Income-driven Repayment (IDR) Plan proposed by the Biden administration.

This article contains all the information you need about requirements for student loan forgiveness to make it easy to request your student loan forgiveness.

What is Student Loan Forgiveness?

Student loan forgiveness in the United States involves government initiatives aimed at relieving eligible borrowers of the obligation to repay part or all of their federal student loans. Its purpose is to reduce the financial burden of student loan debt, especially for those in low-paying public service positions or underserved areas.

For federal student loans, the US Department of Education offers several student loan forgiveness options. In certain circumstances, you may be eligible to have some or all of your student loan forgiven. Depending on your qualification, like employment, you may be eligible to have your student loans forgiven.

Several types of loans are eligible for forgiveness. However, only borrowers who work in the public sector, education, or the armed forces are eligible for student loan forgiveness.

How You Can Qualify for Federal Student Loan Forgiveness?

Several factors determine your eligibility for federal student loan forgiveness, such as your job history, your disability status, and whether you were defrauded by the college you attended. Compared to federal loans, private student loan forgiveness programs are significantly less common.

If you face difficulties in meeting your private loan payments, you have the option to request a loan modification from your lender.

Each federal student loan forgiveness option operates slightly differently. A few require you to meet a minimum number of timely monthly payments before you can petition for forgiveness, such as Public Service Loan Forgiveness.

Others, such as the cancellation of the Perkins loan, offer continuous forgiveness after years of satisfactory service. You will typically need to present documentation of your eligibility.

Top 7 Student Loan Forgiveness Programs

Student loan forgiveness programs are government initiatives designed to help borrowers reduce or eliminate their student loan debt. There were several student loan forgiveness programs in the United States. Here’s an overview of the major student loan forgiveness programs:

1. Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness is a federal program in the United States that provides debt relief to public sector workers. After making 120 qualifying payments, eligible individuals working in government or nonprofit roles can have their remaining student loans forgiven.

This program offers a tax-free way for people with public service careers to reduce their student loan burden, but successful student loan forgiveness requires adherence to specific program criteria.

2. Teacher Loan Forgiveness

The purpose of the Teacher Loan Forgiveness is to assist teachers. Teachers who work in low-income schools or educational service agencies, as well as those who teach certain subjects like science or math, can apply for loan forgiveness of up to $17,500. Other subject teachers may be eligible for $5,000 student loan forgiveness.

To be eligible, teachers must have completed five years of full-time teaching. This initiative serves as a valuable means of reducing the financial burden of student debt for dedicated teachers, especially those who contribute to education in disadvantaged areas.

3. Income-driven Repayment (IDR) Forgiveness

The most recent version of Income-driven Repayment Plans is Biden’s SAVE proposal. If you are unable to make your payments under the normal 10-year repayment schedule, this student loan forgiveness is a viable option for you. Using this method, you sign up for an IDR plan, whose monthly installments are determined by your family size and your discretionary income.

Depending on your circumstances, you may be eligible for a significantly lower monthly payment than you currently have.

Depending on the plan you choose, your repayment tenure could be 20 to 25 years. After the completion of your repayment period, any remaining balance is subject to forgiveness. However, the amount of canceled loans may be subject to income tax. These schemes offer flexible payment solutions to borrowers with different income levels.

4. Closed School Discharge

Closed School Discharge is a federal initiative in the United States that assists students affected by the closure of their educational institutions. If a school closes while a student is enrolled or shortly after they withdraw, they may be eligible for this program. This releases them from their federal student loan obligations, providing a financial safety net for those affected by the institution’s closure.

5. Military Service Loan Forgiveness

Military Service Loan Forgiveness programs provide financial relief to military personnel. These programs, dependent on military branch and service conditions, often include reduction or forgiveness of student loan debt as a token of appreciation for their service. They serve as a valuable incentive for individuals considering or pursuing military careers while assisting in managing their educational debt.

6. Perkins Loan Cancellation

Perkins Loan Cancellation is a federal program in the US that gradually forgives Perkins loans for individuals in specific occupations. Generally, this program benefits teachers, nurses, and people engaged in public service. Over time, as a token of appreciation for their service in these important roles, a portion or all of the Perkins loan may be forgiven, providing relief from their student loan obligations.

Teachers, full-time nurses, or medical technicians will be eligible for up to 100% student loan forgiveness for five years of their eligible service.

7. State-specific Program

State-specific programs for student loan forgiveness are initiatives provided by individual US states. These programs are designed for residents of a particular state who work in specific sectors or underserved areas. While eligibility criteria and benefits vary by state, the overarching goal is to retain skilled professionals in in-demand fields and promote careers in public service. These state-level programs complement federal options and address unique regional needs.

Eligibility Criteria/Requirements For Student Loan Forgiveness

To achieve student loan forgiveness, it is essential to comprehend and meet the requirements for student loan forgiveness. These prerequisites can differ based on the forgiveness program you select. Let’s explore the eligibility criteria for some of the prevalent student loan forgiveness programs in the United States.

Public Service Loan Forgiveness (PSLF)

- You must work full-time for a qualifying government or non-profit organization.

- You must make 120 eligible payments while working at an eligible job.

- Your loans must be direct.

Teacher Loan Forgiveness

- You must be a teacher in a low-income school or educational service agency.

- You have to teach continuously for five years.

- You must have certain types of loans.

Income-Driven Repayment Plan Forgiveness

- You will have to make payments on an income-driven repayment plan for 20 to 25 years.

- Your remaining balance is forgiven after the repayment period.

- If you work in the public service and have an income-driven repayment plan, your loans can be forgiven after 10 years of payments.

Perkins Loan Cancellation

- Eligibility varies, but teachers, military personnel, and some other public servants may be eligible for Perkins Loan Cancellation.

Closed School Discharge

- If your school closes while you are enrolled or within 120 days of withdrawal, you may be eligible for discharge.

State-specific Program

- You must be a resident of the particular state for student loan forgiveness.

- You need to work in a specific field or occupation that meets your state’s eligibility requirements for student loan forgiveness.

Military Service Loan Forgiveness

- You are required to have active duty military service.

- It varies depending on the military service period.

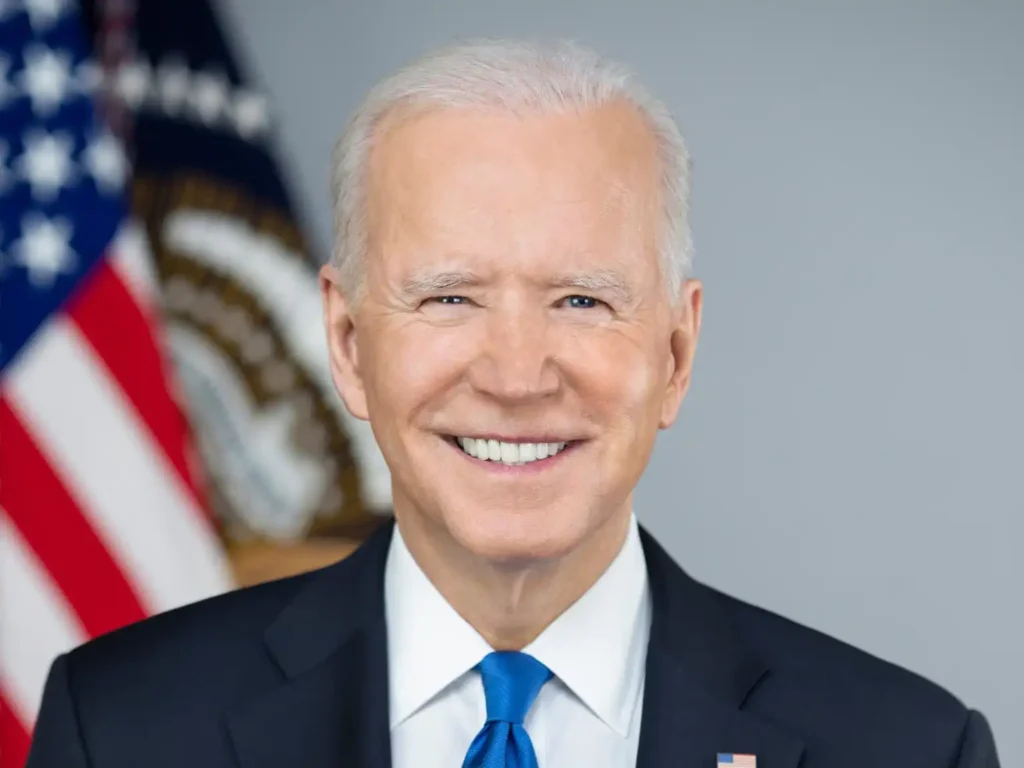

Biden’s Proposed Student Loan Forgiveness

Biden’s Proposed Student Loan Forgiveness is very significant. On June 30, 2023, the Supreme Court decided that Joe Biden’s government was not authorized to forgive student loans under the Higher Education Relief Opportunities for Students Act of 2003.

In response, Biden unveiled a revised plan for student loan payment refunds that shortens the period before loans can be canceled and lowers the minimum payment for some students. Additionally, he announced that the Department of Education would adopt a different strategy for student loan forgiveness.

According to Biden’s plan, if you have federal student loans and made less than $125,000 per year (or $250,000 for families), you would be eligible for this one-time student loan payment refund.

How Do You Apply for Student Loan Forgiveness?

In the United States, various student loan forgiveness programs exist, each having its distinct set of prerequisites and application protocols. Here is an overview of the application process for student loan forgiveness, emphasizing the Requirements for Student Loan Forgiveness.

- Determine Eligibility: Your initial task is to make sure you meet the eligibility criteria for the particular forgiveness program you have in mind. Notable programs include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) Forgiveness, among others. Eligibility often depends on factors, such as your business, the repayment plan chosen, and the type of loan you have taken.

- Consolidate Your Loans: In case of having multiple federal student loans, consider streamlining them into a Direct Consolidation Loan. This step is required for some forgiveness programs, notably PSLF.

- Meet Qualifying Payment Requirements: To qualify for student loan forgiveness through programs like PSLF and IDR, you are typically obligated to make a specific number of qualifying payments. These payments need to be made while working in a qualifying profession or following an income-driven repayment plan. Typically, you must make payments for ten years to be eligible for PSLF.

- Complete the Application: Find the appropriate forgiveness application form and complete it. These forms can often be found on the Federal Student Aid website or through your loan servicer. It is important to pay close attention to details to ensure the accuracy of your submission.

- Submit Required Documentation: Some student loan forgiveness programs like PSLF, require the submission of documentation to prove your eligibility. For teacher loan forgiveness, you may be asked to prove your teaching service.

- Wait for Approval: After submitting your application and supporting documents, the next step is to be patient while your forgiveness application goes through the review process. The length of this process may vary, so be prepared to wait.

- Maintain Regular Payments: It is important to continue paying your loans until you receive official confirmation of forgiveness approval. Stopping payments early may jeopardize your eligibility.

FAQs.

1. What is the process for determining if my student loans have been forgiven?

To find out if your student loans have been forgiven, contact your loan servicer or access the Federal Student Aid website (studentaid.gov). Make sure you meet the eligibility requirements and complete the required documentation to confirm your student loan forgiveness status.

2. Who pays for student loan forgiveness?

Funding for student loan forgiveness is primarily provided by the government through federal tax revenues. Government initiatives, such as public Service Loan Forgiveness and Income-driven Repayment Plans, allocate funds to cover the forgiven loan amount.

While some programs have specific requirements, the primary source of funding is public resources.

3. Does graduate student debt qualify?

Yes, graduate student loans are eligible for several student l loan forgiveness programs, such as Income-driven Repayment and Public Service Loan Forgiveness. However, eligibility criteria and requirements vary.

4. Who is not eligible for the Public Service Loan Forgiveness?

Individuals employed by contracting organizations that are not eligible employers are ineligible for PSLF, including government contractors and people working for for-profit entities.

Conclusion

The requirements for student loan forgiveness are important in reducing the financial burden on borrowers. These prerequisites vary depending on the specific forgiveness program. But, it often includes elements, such as an income-based repayment plan, public service employment, or disability.

It is important for borrowers to have a comprehensive understanding of the eligibility requirements for their chosen student loan forgiveness program and to stay updated on any legislative changes that may impact their eligibility.

Add Comment