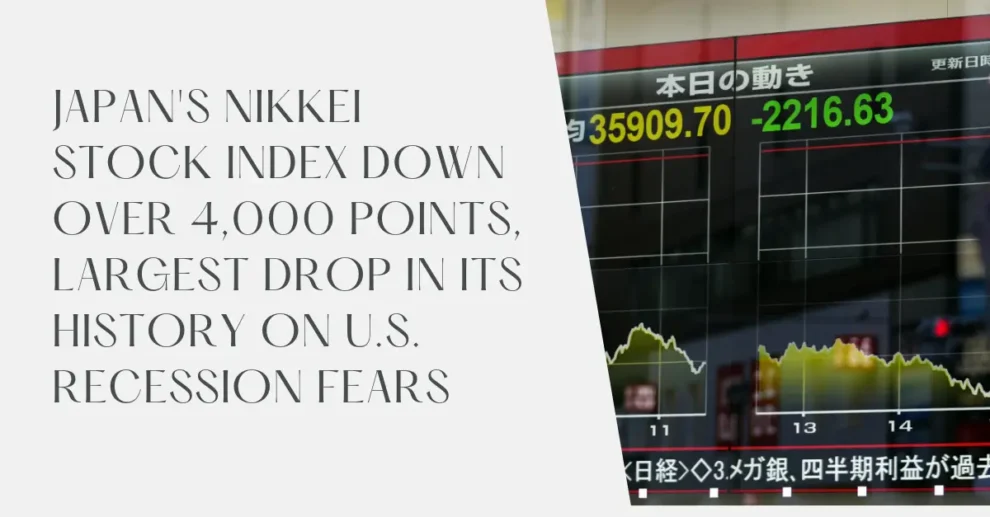

The Nikkei stock index fell more than 4,000 points on Sunday, marking the largest points drop in history. This was part of a global market meltdown sparked by worries about a potential U.S. recession after weaker-than-expected economic statistics.

After the sharp decline the day before, sentiment deteriorated even further, and selling of export-related auto and electronics issues was prompted by the yen’s recent strengthening versus the US dollar.

The Nikkei Stock Average, which has 225 issues, closed at 35,909.70, its lowest closing since January 26, down 2,216.63 points, or 5.81 percent, from Thursday. The overall Topix index closed at 2,537.60, its lowest level since February 1, down 166.09 points, or 6.14 percent.

Every industry category on the elite Prime Market saw a decline, with bank, insurance, and securities house issues leading the way.

Following disappointing weekly jobless claims and industrial statistics in the greatest economy in the world, shares continued to fall as a risk-off sentiment pervaded, sending U.S. and other markets substantially lower.

The Nikkei’s decline on Friday was the biggest one-day decrease in history since Oct. 20, 1987, the day following the Black Monday stock market disaster, when the benchmark fell 3,836 points.

When the Bank of Japan hiked interest rates on Wednesday and BOJ chief Kazuo Ueda did not rule out the potential of additional hikes later this year, the dollar continued to face pressure and sank to the upper 148 yen level.

The dollar was trading at 149.20–23 yen at 5 p.m. on Thursday, versus 149.36–46 yen in New York and 149.85–87 yen in Tokyo.

In New York, the euro was quoted at $1.0804-0805 and 161.21-25 yen, while in Tokyo, it was at $1.0801-0802 and 161.86-90 yen late on Thursday afternoon.

As investors purchased the safe-haven asset amid plunging Tokyo equities, the yield on the benchmark 10-year Japanese government bond dropped 0.075 percentage points from Thursday’s closing to 0.955 percent, the lowest since late June.

According to Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory Co., stocks have dropped globally due to worries about the weak U.S. jobs data that is scheduled for release later this Friday and the possibility that the Federal Reserve, which many predict will begin lowering interest rates in September, may be too late to support the economy.

According to Suzuki, “there was talk of additional rate hikes in Japan when fears were heightening over a U.S. recession,” which caused Tokyo’s stock drops to be more severe than those of other markets.

The Nikkei index closed above the 42,000 mark for the first time on July 11th, amid forecasts of a soft landing for the U.S. economy and confidence about the earnings of Japanese companies due to a weakening yen. The Tokyo stock market has been rising recently.

Brokers reported that there have been short-term oversold signs for the Nikkei following the recent sell-offs, and they anticipate that dip-buying would take place the next week.

“Even if the U.S. employment data turn out to be weaker than expected, investors may have already priced in the outcome,” Suzuki stated. “Such an outcome could raise expectations for (more) rate cuts this year by the Fed and boost the market.”

Add Comment